Eurozone Sees Third Straight Month of Upbeat Economic News

Businesses in the Eurozone have seen their third straight month of growth.

According to The Wall Street Journal, this upward climb has been driven in a large part by stronger-then-expected economic numbers coming from Germany’s services and manufacturing sectors.

This is welcome news for a region that has long been struggling with economic inertia brought on by rising interest rates and spikes in the costs of food and energy after Russia’s invasion of Ukraine. This upbeat economic news is also undoubtedly being embraced by executives managing the companies Visa and PYMNTS Intelligence label “Growth Corporates,” or middle-market organizations generating between $50 million and $1 billion in annual revenues that can be overlooked in favor of smaller businesses and larger enterprises.

We recently looked at the impact that working capital can have on Growth Corporates round the globe and issued our findings in a series of reports.

The “2023-2024 Growth Corporates Working Capital Index: Europe Edition” zoomed in on middle-market firms in Europe and found 79% of them accessed working capital solutions in the past year — a greater share than nearly all of the other regions we studied.

The report — which is primarily based on surveys with more than 100 middle-market CFOs or treasury executives, with additional support from our global surveys of 873 CFOs and treasurers — found that European Growth Corporates are primarily leveraging external capital solutions to obtain favorable capital costs or to underwrite new business endeavors and partnerships. However, PYMNTS Intelligence also determined that many of them are using that capital inefficiently.

But not all of them. The top-performing mid-market companies in Europe operate similarly to top performers in other analyzed regions in that they predominantly use external working capital solutions for strategic purposes, rather than as tactical quick-fixes. (Those others regions studied include: the Asia-Pacific (APAC) region; Central Europe, the Middle East and Africa (CEMEA); Latin America and the Caribbean (LAC); and North America.)

In the case of Europe, 73% of top performers used working capital for growth initiatives, while 24% applied the funds to expected cash flows. Interestingly, none of the top-performers in Europe used their funding solutions to address unexpected gaps or opportunities — strategies that do not correlate with best-practice efficiencies.

Conversely, 37% of bottom-performing Growth Corporates in Europe accessed external working capital solutions for emergency needs last year, while 19% of middle-performers did the same. In other words, financial emergencies hindered the best intentions of European middle-market companies, allowing them to let unexpected or urgent needs take precedence over strategy.

It remains to be seen whether the recent economic uptick in Europe will reduce unforeseen emergencies in the boardroom, yet these mid-market firms can stick to their game plans, which include how they intend to access working capital going forward.

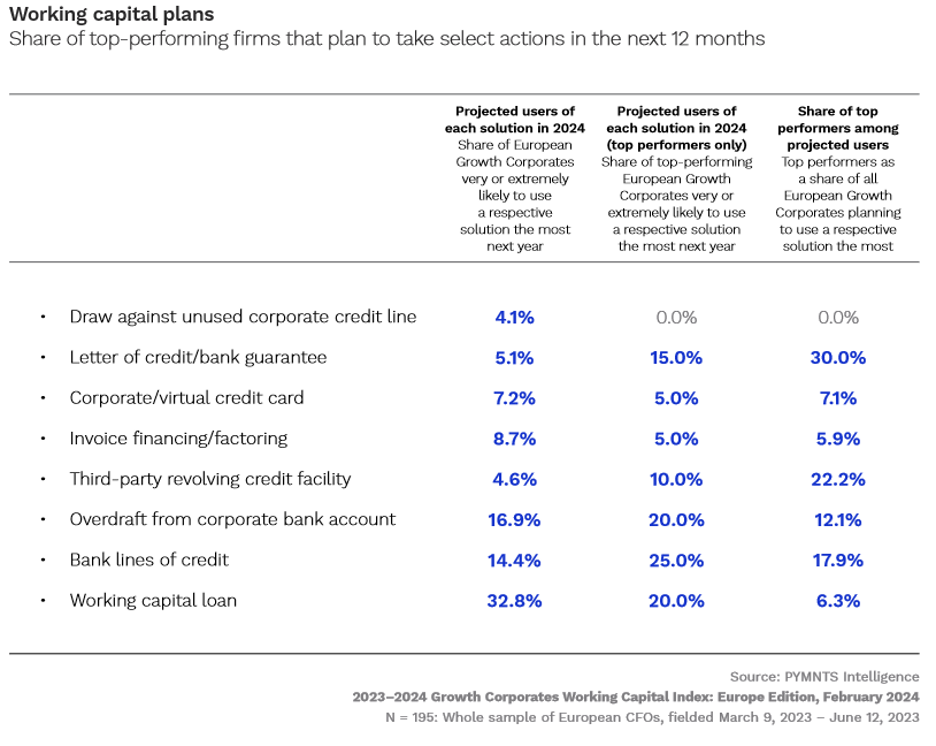

When we asked top-performing Growth Corporates in Europe how they intended to access funding in the months to come, letters of credit or bank guarantees were particularly popular: 30% said they plan to rely on this form of funding. Meanwhile, only 5.1% of European mid-market firms in general plan to access letters of credit or bank guarantees.

Similarly, 22% of top-performing respondents planned to leverage third-party revolving credit solutions, while only 4.6% of Growth Corporates in the region overall intend to do the same. This differential suggests that greater usage of either of these may lead to higher performance.

And conversely, while 33% of Growth Corporates in Europe are counting on working capital loans, less than 7% of top performers are doing so, suggesting that lower-performing Growth Corporates may be over-relying on this solution.

It’s still too soon to determine if Europe’s gradually-improving economic picture will translate into a windfall for middle-market companies in the region, but it’s not too soon for company executives in those organizations to study which working capital solutions top performers plan to leverage — and try not to be left behind.