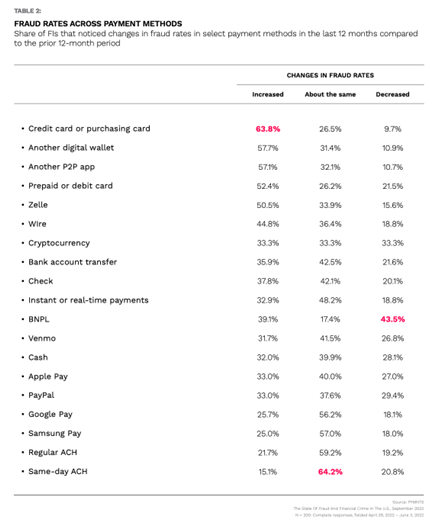

64% of FIs Report Increases in Fraud Attacks on Credit and Debit Cards

The heated battle between fraudsters and financial institutions (FIs) got hotter during the pandemic-era run-up in eCommerce and the use of alternative payment methods. This joyless game of whack-a-mole is keeping fraud fighters busy, but their adversaries never sleep.

This is analyzed in “The State Of Fraud And Financial Crime In The U.S.,” a PYMNTS and Featurespace collaboration based on surveys of more than 200 executives working at FIs with assets of at least $5 billion.

In the macro view, we found that 66% of respondents “cited complex regulatory requirements as a challenge preventing executives from trying new technical options to protect their organizations. Additionally, 40% of all executives cited concerns over the potential complexity involved in using new technologies, and the same percentage also cited the presumed complexity of integrating new technologies with existing systems as factors inhibiting innovation to combat fraud.”

That’s important as new payments tech requires up-to-date anti-fraud defenses to hold back the tsunami of online funds theft that has marked the pandemic era.

Crooks have their favorite go-to payment methods — and even types of FIs — when plying their pernicious trade. Fraudsters especially targeted credit cards, we found, as 64% of FIs “reported an increase in fraud attacks using them. For comparison, 52% of FIs noticed attacks on debit or prepaid cards increased. In addition, we found that 32% of firms saw an increase in fraud rates related to payments made with Venmo and 51% of firms saw an increase in fraud rates related to payments made with Zelle.”

Additionally, the research found variances in attacks across more FIs of different sizes, as well as the targeting of specific payment methods on the rise.

Per the study, “Smaller FIs had the highest rates of increased fraud attacks in credit cards, with 66% reporting increased attacks on that payment method, and prepaid or debit cards, with 61% reporting increases. Smaller FIs also saw the highest rates of increased rates of fraud among peer-to-peer (P2P) and rapid payment methods: 56% reported increased fraud attacks using Venmo in the past year, 51% reported increases using Zelle, 48% saw increases using PayPal and 42% saw more fraud attacks using instant and real-time payment rails.”

Among the largest FIs, 63% reported increased fraud attacks via wire, 44% cited increases among buy now, pay later (BNPL) options and 38% saw increases in cash-based fraud.”

Get Your Copy: The State Of Fraud And Financial Crime In The U.S.